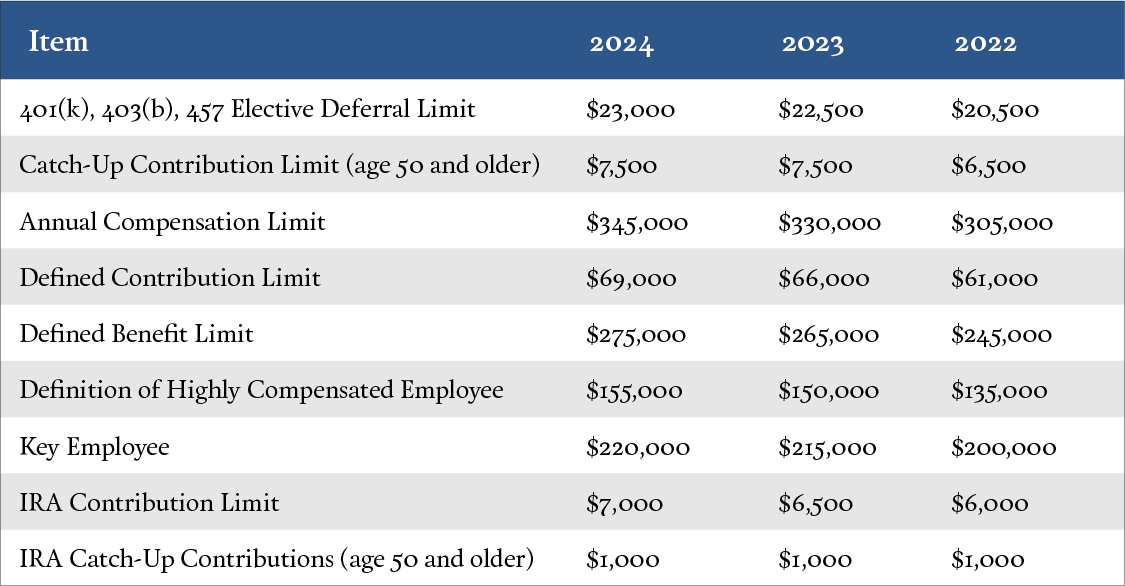

401k Help Center 2025 Limits. In 2025, the irs has increased the standard employee contribution limit for 401(k) plans to $23,000. Traditional and roth ira contribution limits increased to $7,000.

The roth 401 (k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions.

401k Annual Limit 2025 Reeva Celestyn, 401(k) employee contribution limits increase in 2025 to $23,000 from $22,500 in 2025. On nov., 1, 2025, the irs boosted annual contribution limits for 2025 for 401(k), 403(b), and most 457 plans.

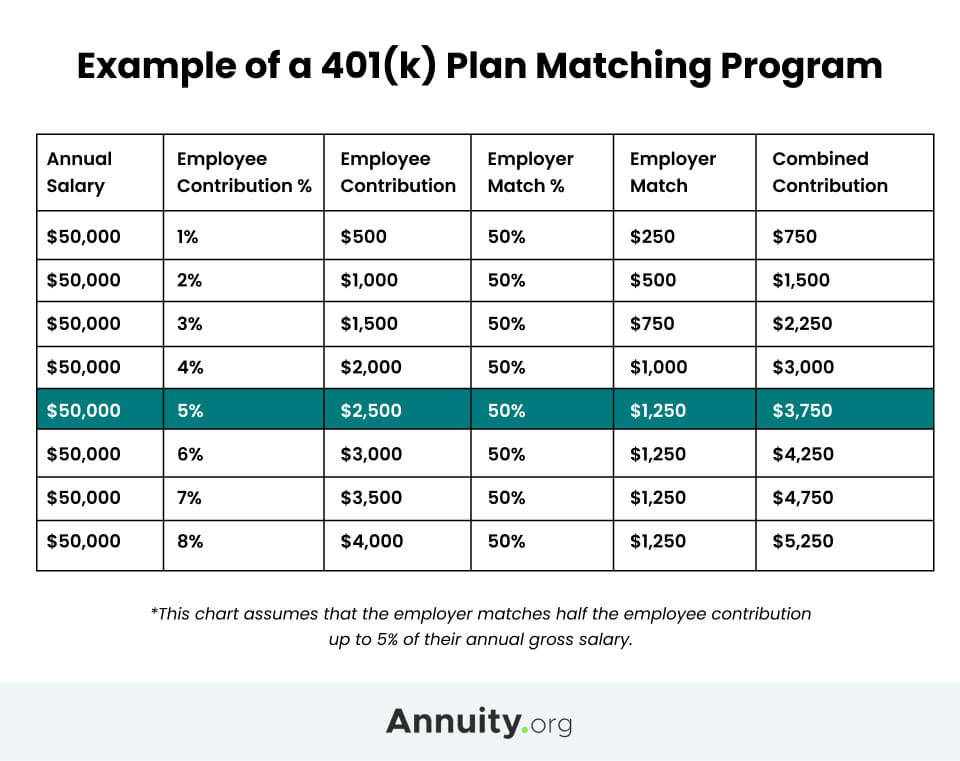

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, Those 50 and older can contribute an additional $7,500 in 2025 and 2025. In addition, your employer may offer matching,.

2025 401k Limit Kelly Melisse, As of 2025, individual employees have a 401 (k) contribution limit of $22,500, allowing them to contribute this amount annually to their 401 (k) account on a. The 401(k) contribution limit is $23,000.

Maximum Defined Contribution 2025 Sandy Cornelia, The 401 (k) contribution limit for individuals has been increased to $23,000 for 2025. Here's how the 401(k) plan limits will change in 2025:

What Are the Maximum 401(k) Contribution Limits? GOBankingRates, On november 1, 2025, the internal revenue service announced that the amount individuals can contribute to their 401(k) plans in 2025 has increased to $23,000, up from $22,500 for 2025. The 2025 401(k) contribution limit is $23,000 for people under 50, up from $22,500 in 2025.

Free 401(k) Calculator Google Sheets and Excel Template, Use a free paycheck calculator to. The 401(k) contribution limit is $23,000.

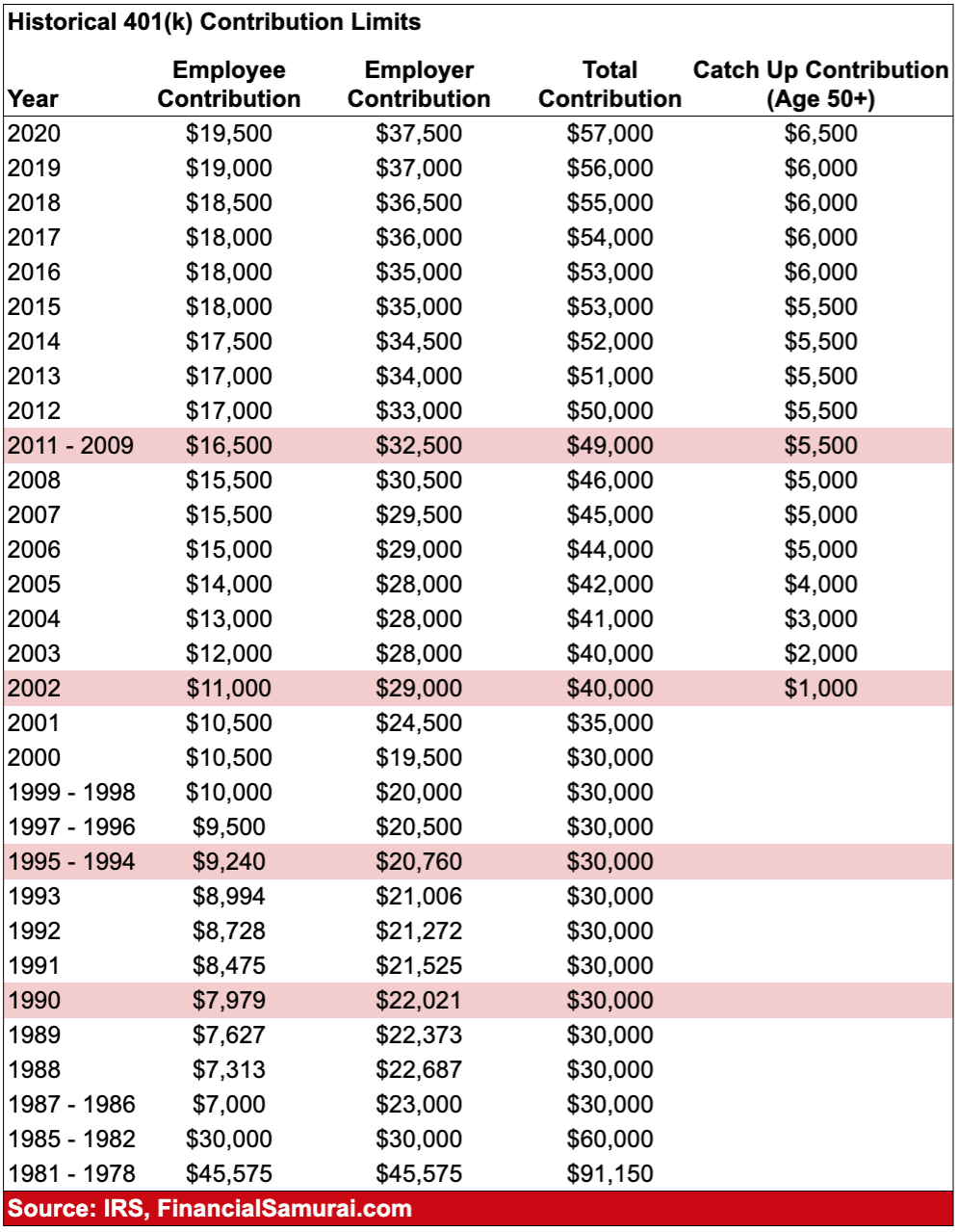

Historical 401k Contribution Limits Employer Profit Sharing Is Significant, The roth 401 (k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions. Traditional and roth ira contribution limits increased to $7,000.

401k Limits for 2025! Contribution Limits and All Details Gud Story, As of 2025, individual employees have a 401 (k) contribution limit of $22,500, allowing them to contribute this amount annually to their 401 (k) account on a. 401 (k) contribution limits 2025.

SelfDirected Individual 401k Plan Advantages, Eligibility, Understanding 401k contribution limits for 2025. The 401(k) contribution limit is $23,000.

401k 2025 Limits Dani Millie, 401k and retirement plan limits for the tax year 2025. Simple retirement plan contribution limits increased to $16,000 in 2025 (up from $15,500 in 2025).

In 2025, think of your 401k, thrift savings plan, or 457 plan like a garden where you can grow your money for the future, with an increased limit on annual.